Empower yourself with knowledge. Understanding the truths and myths of credit is the first step to building a stronger financial future.

This is a widespread myth. Closing older accounts can actually hurt your score by reducing your average age of credit history and increasing your credit utilization ratio.

This is false. You don’t need to carry a balance and pay interest to build credit. Paying your balance in full every month is the best practice for a healthy score.

When you check your own credit (a ‘soft inquiry’), it has no impact on your score. A ‘hard inquiry,’ which occurs when a lender checks your credit for an application, can have a small, temporary negative effect.

Payment history is the single most important factor in your credit score. Even one late payment can have a significant negative impact.

Aim to use less than 30% of your available credit on each card and across all your accounts. Lower is generally better.

If you have a trusted friend or family member with a long history of responsible credit use, ask them to add you as an authorized user on one of their accounts. Their good history can benefit your score.

Check your credit report from all three major bureaus (Equifax, Experian, and TransUnion) regularly to look for errors or fraudulent activity.

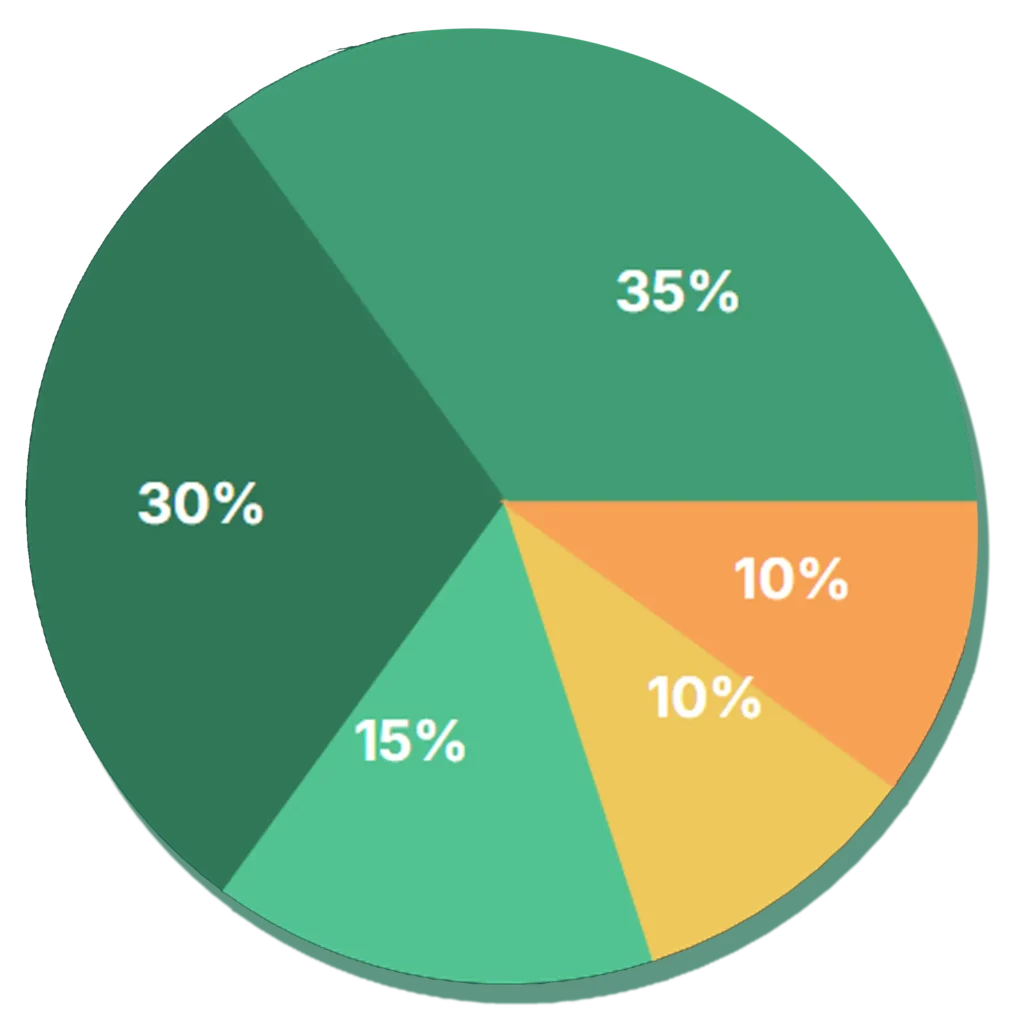

Your credit score is calculated from several key pieces of information in your credit report. Understanding these factors is the first step toward improving your score. While the exact formulas are secret, FICO has shared the approximate importance of each category.

Approximate weight of each factor

Don’t wait another day to take control of your financial future. Our team of experts is ready to help you achieve the credit score you deserve.